Japan-China Capital Partners commits

to the development

of both Japan and China.

Message from the Management

Japan-China Capital Partners Co., Ltd. (JCCP) invests in Japanese companies, Chinese companies and third-country companies seeking to enter the Chinese market, while promoting overseas expansion of investee companies by increasing corporate value. JCCP is established to deepen trade and investment cooperation between Japan and China.

Japan and China have greatly increased their total trade and foreign investment and are strengthening their economic ties while transfiguring their roles. Under such environment, JCCP takes an integral role in accelerating further economic cooperation between the two countries as well as accompanying development and make efforts for the development of both countries.

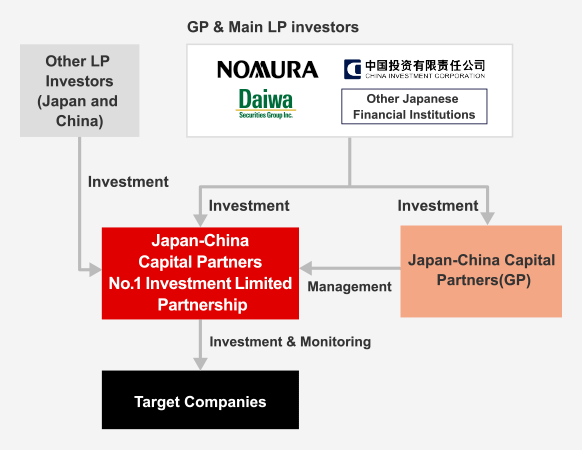

JCCP strengthens the management of investee companies, formulates growth strategies, and supports execution by maximizing the capabilities of Nomura Holdings, Inc., China Investment Corporation, Daiwa Securities Group Inc. and other Japanese Financial Institutions to maximize growth and investment return.

We would like to ask for your continued support.

Investment Activity

Key Characteristics of JCCP

- 1

Investment Objectives

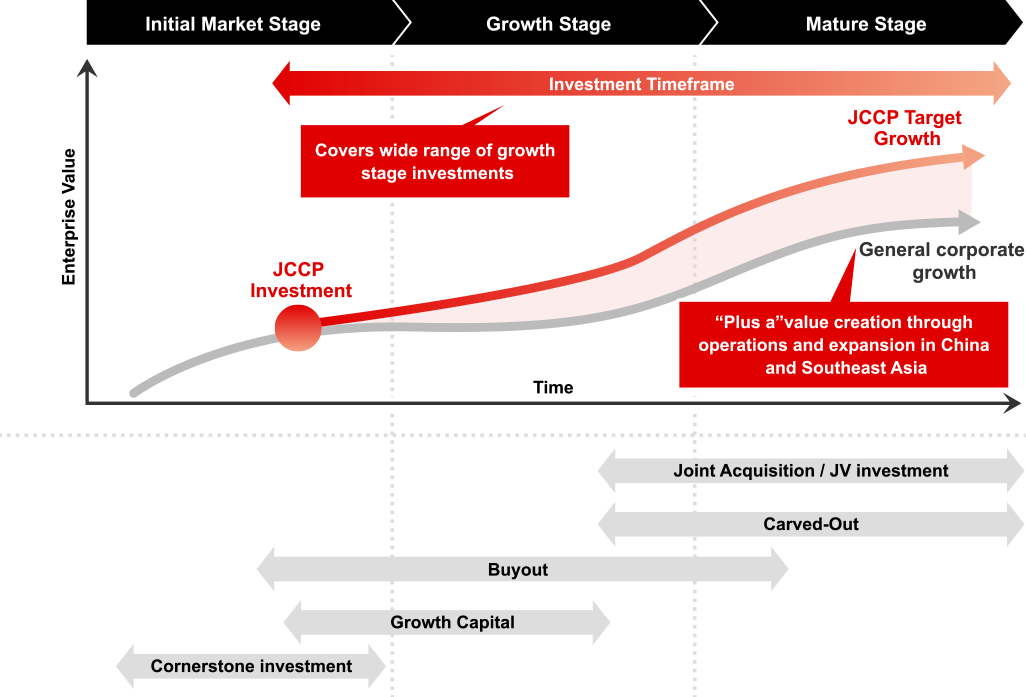

Provide growth funding to companies with a dynamic Japan and China business cooperation for a potential maximum growth through operations and expansion in China and Southeast Asia.

- 2

Value Up System

Utilize the expertise of team members in the Chinese market and the networks of GP shareholders such as Nomura Holdings, Inc., China Investment Corporation, Daiwa Securities Group Inc., and other Japanese Financial Institutions to strongly support the business development of investee companies.

- 3

Governance System

Promote proper and efficient fund management through a governance system in which each GP shareholder company actively participates in the Investment Committee and Board of Directors.

Potential value creation for companies expanding to China and Southeast Asia

Fund Overview

Corporate Profile

Japan-China Capital Partners Co, Ltd.

Shareholders:

China Investment Corporation*

Other Japanese Financial Institutions

* Investment by its subsidiary

Funding

Japan-China Capital Partners No. 1 Investment Limited Partnership

Main LP Investors:

Nomura Holdings, Inc.

China Investment Corporation*

Daiwa Securities Group Inc.

Other Japanese Financial Institutions

* Investment by its subsidiary

Investment Strategy

Fund structure outline

Company Profile

Company name

Japan-China Capital Partners Co., Ltd.

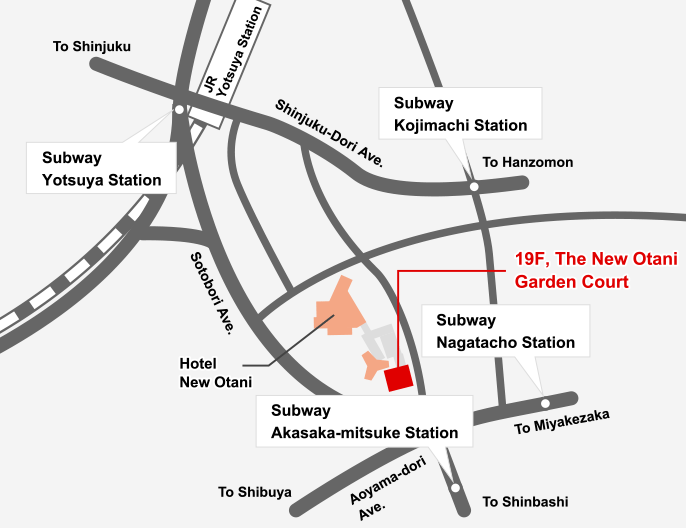

Address

19F, The New Otani Garden Court 4-1, Kioi-cho, Chiyoda-ku, Tokyo 102-0094, Japan

TEL: +81-3-6261-6263

Director

Chief Executive Officer, Kenji Sugiyama

NEWS

Inquiries

For inquiries regarding our services, please contact the following:

Japan-China Capital Partners Co., Ltd., Management Department

Business Hours:

Monday to Friday from 9 am to 5 pm, excluding holidays and non-business days

Address :

19F, The New Otani Garden Court 4-1, Kioi-cho, Chiyoda-ku, Tokyo 102-0094, Japan

Privacy Policy

This English translation is only for reference purpose. When there are any discrepancies between original Japanese version and English translation version, the original Japanese version always prevails.

Privacy Policy

Japan China Capital Partners Co., Ltd. and its officers, employees, etc. shall comply with the Act on the Protection of Personal Information, the Act on the Use of Numbers to Identify a Specific Individual in Administrative Procedures, relevant laws and regulations, and guidelines of supervisory authorities, and establish the following basic policies.

- 1.Personal information, including personal numbers (Hereinafter referred to as "Personal information, etc.".), is obtained in accordance with laws and regulations, and efforts are made to ensure that the content is accurate and up to date.

- 2.Personal information, etc. shall not be used beyond the scope of the purpose of use. Individual numbers are handled only within the scope prescribed by laws and regulations. In addition, we will not disclose or provide personal information, etc. to third parties without the consent of the individual concerned, unless there are justifiable reasons such as the obligation of disclosure based on laws and regulations.

- 3.To prevent the leakage and unauthorized use of personal information, etc., we will thoroughly educate officers and employees. In addition, a person in charge of management and inspection will be appointed to establish an appropriate management system.

- 4.When personal information, etc. is handled by outsourcees, supervisors shall responsibly supervise them to ensure that their personal information, etc. is protected.

- 5.Personal information, etc. shall be disclosed, corrected, or discontinued in accordance with laws and regulations at the claim of individuals. In this case, the prescribed fee may be charged.

If you have any questions about personal information, such as the purpose of use, disclosure, correction, suspension of use, please contact the Personal Information Consultation Office (Japan-China Capital Partners Co., Ltd., 4th floor -1 New Otani Garden Court 19th floor, Kioi-cho, Chiyodaku, Tokyo 102 - 0094 Tel: +81-3-6261-6263).

For requests for disclosure, etc., we ask to submit the request form and other necessary documents specified by us to verify your identity.

Purpose of use of personal information

- 1.For solicitation, sales, and management of business investment projects, financial products, financial transactions, and other products handled, as well as providing information on services related thereto (Including display of optimal sites, advertisement distribution and other sales activities using analysis results such as customer browsing history)

- 2.For providing information on business investment projects, financial instruments, financial transactions and other products and services handled by our company, its affiliates, and affiliated companies, as well as introducing related companies

- 3.To determine the appropriateness of business investment projects, financial instruments, financial transactions, and other products and services handled considering the principle of suitability

- 4.To confirm that you are the customer or an agent of the customer

- 5.To report the results of transactions and the balance of deposits to customers

- 6.To handle business affairs related to transactions with customers and business partners

- 7.With respect to the execution of rights and obligations under contracts with customers and business partners, laws, and regulations, etc.

- 8.Research and development of business investment projects, financial products, financial transactions, and other products and services through market research, data analysis, and questionnaire surveys

- 9.To appropriately perform the entrusted work in cases where the processing of personal information has been entrusted in whole or in part by other business operators, etc.

- 10.In addition, to conduct transactions with customers and business partners appropriately and smoothly

- 11.Regardless of the purpose of use of the personal information in each of the preceding items, the personal number shall be used only for "Application and Notification for Opening Accounts for Financial Instruments Transactions" and "Preparation and provision of statutory documents concerning financial instruments transactions".

- 12.To continue to use personal information within the scope of the purpose of use of personal information in each of the preceding items even after the end of transactions with customers.

Sensitive information is not used or provided to third parties for purposes other than proper business operations and other purposes deemed necessary.

We may record calls with you.

Solicitation Policy

JCCP complies with the "Act on the Provision of Financial Services" and "Financial Instruments and Exchange Act" and other relevant laws and regulations and will solicit customers for financial products in an appropriate manner in accordance with the following policies.

Security Control Measures for Personal Data

Based on the laws and ordinances for financial instruments and exchange, laws and regulations for personal information protection, related guidelines, and the rules of the Japan Securities Dealers Association, we have implemented the following security control measures for personal data.

(Development of Discipline in the Handling of Personal Data)

(Organizational Security Control Measures)

(Physical Security Control Measures)

(Technical Security Control Measures)

(Personnel Security Control Measures)

Please note that we may not be able to respond to inquiries about security details.

(March 2022)